In our last blog we pointed out that the number of CAR-immunotherapy clinical trials has grown 25-fold over the past decade, and that 56% of the 2019 immunotherapy trials were some type of CAR-immunotherapy (CAR-T alone were 54%).

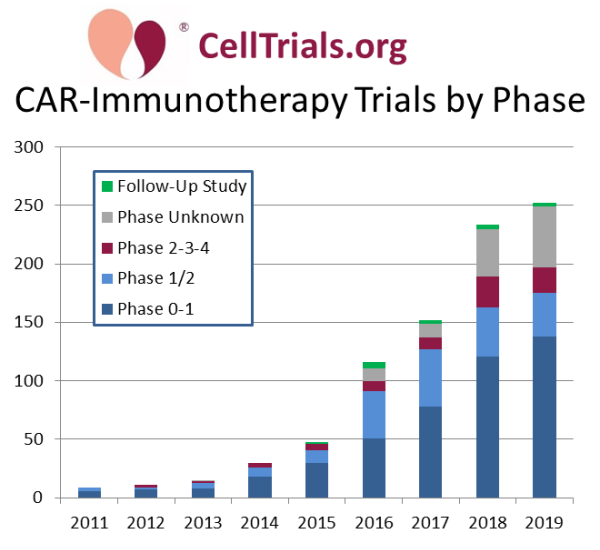

In today’s blog we look at the source material for all immunotherapies that employ a Chimeric Antigen Receptor (CAR) construct, covering both CAR-T and CAR-NK therapies. Our first graph displays the number of CAR-immunotherapy trials registered per year, color-coded by trial phase. At CellTrials.org, we have a data product dedicated to the details of CAR-immunotherapy clinical trials, and we update this graph every year to illustrate the growing number of late-phase and follow-up trials.

The dramatic successes of the initial CAR-T therapies have transformed oncology. But it has rapidly become clear that performing apheresis on patients to harvest autologous immune cells for the manufacture of personalized therapies is both time-consuming and expensive.

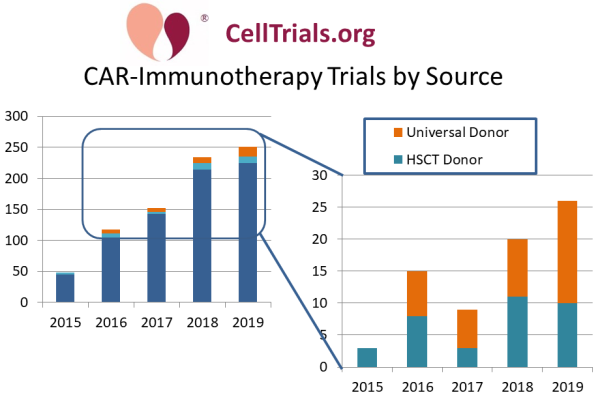

In recent years, clinical trials have emerged which perform CAR-immunotherapy with allogeneic cells. There are two types of allogeneic donors in these trials. In trials where the patient is getting a hematopoietic stem cell transplant (HSCT), one approach is to use cells from the HSCT donor to also manufacture a CAR-T therapy. The other approach is to manufacture a CAR-immunotherapy from a universal donor source, to achieve an off-the-shelf CAR product.

Our second graph displays the past five years of CAR-immunotherapy trials color-coded by source material, and then zooms in by a factor of ten to display the trials using allogeneic source material. For the year 2019, 10% of CAR-immunotherapy trials relied on some type of allogeneic cell source. This is a minimum estimate that only includes trials which explicitly say that they are using an allogeneic or universal donor cell source.

These registered clinical trials are the result of a bigger shift that we see in corporate research and development. At CellTrials.org, we also have a data product that tracks worldwide companies that are developing CAR-immunotherapy. Starting from the 203 companies in our March database, we sorted them by cell source, counting each company towards each type of source material from which they manufacture. The resulting pie chart below has a 20% contribution from universal donor CAR-immunotherapy.

.png)

We forecast that CAR-immunotherapy sourced from universal donors is a growth field. At present we list 43 companies that are developing products in this field. Their technology platforms include CAR-T cells obtained by apheresis from healthy donors, CAR-T or CAR-NK cells developed from cord blood or placental blood, and CAR-T or CAR-NK manufactured from iPS cell lines. It is notable that most of the companies that are using cord/placental blood or iPS lines as the starting point for their products are still in preclinical development, which is why we can confidently predict future growth in this category of clinical trials.