Posted December 2019:

This blog is a follow up to the paper published in Sept. 2019, titled Regulations on cell therapy products in China: a brief history and current status, by Li, Verter, Wang & Gu (Regenerative Medicine 2019; https://doi.org/10.2217/rme-2019-0069 ).

In our paper, we explained that the Chinese central government has recently revised the regulations that govern cell therapy, and also reorganized the government agencies that regulate medical research and development. Under the new national guidelines, China treats cell therapy products (CTPs) as biologic drugs, consistent with regulatory practices in Western nations. These new regulations became effective at the end of 2017. All previous approvals of CTPs under the old Chinese regulations were erased, resetting the clock for clinical trials of CTPs to move towards Chinese market approval.

Under the new regulatory framework, once a CTP has a record of successful clinical trials, the next step is for the sponsor to submit an Investigational New Drug (IND) application to the Center for Drug Evaluation (CDE), a division of the National Medicinal Products Administration (NMPA), which is the agency that replaced the China FDA as of Nov. 2018. The CDE makes available a list of those products that hold IND status at a web portal named http://www.chinadrugtrials.org.cn/. As of November 2019, there were 64 CTP that had achieved IND status, for 61 diseases, submitted by 41 filing parties.

The fact that CellTrials.org tracks all advanced cell therapy trials in all clinical trial registries worldwide gives us a unique perspective on trials in China. In any given year we have trials conducted in China that were either registered on ClinicalTrials.gov, or registered with the Chinese registry ChiCTR, and occasionally trials in China are registered on other national registries. Our procedure at CellTrials.org is that whenever we find a trial to be double registered on ClinicalTrials.gov plus another registry, we always attribute it to ClinicalTrials.gov.

Our first figure is the number of CTP trials in China versus year, color coded by the registry on which the clinical trial was listed. This figure tells two stories, both of them dramatic.

.png)

The first revelation is that the number of CTP trials taking place in China exploded five years ago, doubling over the years from 2014 to 2015, doubling again in 2016, leveling out for one year, and then increasing by another 33% from 2017 to 2018. So far, the first three quarters of 2019 are on track to produce a yearly total very similar to 2018.

The second dramatic shift is the fraction of CTP clinical trials that are registered outside versus inside China. Remember that China’s new cell therapy regulations went into force at the end of 2017. Through 2017, the majority of CTP trials in China were listed on ClinicalTrials.gov, with a fraction of 21% to 31% listed on ChiCTR each year. Suddenly, starting in 2018 and continuing in 2019, the registration of CTP trials became more China-centric, with about half registered only on ChiCTR.

One distinction between China and Western nations is that China’s new regulations established two different tracks for CTP clinical trials. The existing ChiCTR registry that was founded in 2005 is still used for trials that hope to achieve market approval. There is a new internal registry for research trials that is only accessible by Chinese hospitals and healthcare organizations. The existence of the research registry gives the impression that academic centers would register their CTP clinical trials internally, and the CTP trials listed on ChiCTR would be predominantly sponsored by the biotech industry. However, our data shows the opposite, that in fact ChiCTR is dominated by CTP trials at academic centers.

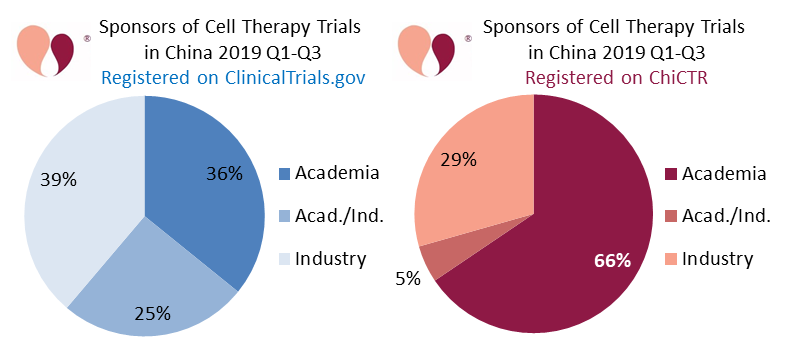

Our second and third figures are a pair of pie charts showing the sponsorship of advanced cell therapy clinical trials registered in China during the first three quarters of 2019 (January through September). The blue pie chart shows 133 CTP trials registered on ClinicalTrials.gov, and the red pie chart shows 119 CTP trials registered on ChiCTR. We label the sponsor as “Industry” if it is a company, “Academia” if the sponsor is a university or hospital, and “Acad./Ind.” if the trial has a combination of collaborating sponsors.

The blue pie chart of Chinese CTP trials registered on ClinicalTrials.gov is fairly evenly split between the three categories of sponsors. By comparison, the red pie chart of CTP trials registered on ChiCTR is dominated by academic sponsors.

There are several possible interpretations for the behaviors in these graphs. The abundance of academic trials on ChiCTR could indicate that Chinese researchers are not content to rely on the new research registry, and/or it could indicate that most researchers hope their CTP clinical trials will be successful and lead to commercial opportunities. The fact that more of the industry sponsored trials appear on ClinicalTrials.gov than on ChiCTR probably reflects the increasing collaboration between Chinese researchers and Western pharma companies.

We close with the reminder that CellTrials.org is the only clinical trials compilation that captures the distribution of advanced cell therapy across registries in multiple countries. Clinical trial statistics for China that rely solely on ClinicalTrials.gov are grossly inaccurate. The trials data underlying this report is now updated through the end of 2019 and is available for purchase here.

Acknowledgements

We received assistance with the preparation of this blog from Yijia Li, PhD, of Tsinghua University, and Ching Lam, MEng AMIChemE, DPhil Researcher in Biomedical Engineering at University of Oxford.